During the recent China Home Appliances and Consumer Electronics Expo, several cleaning appliance companies interviewed by Caixin said that they have made appropriate adjustments to the US tariff turmoil since last year. The global layout of sweepers, floor scrubbers and other products produced by Chinese companies occupy an important position in Europe, Japan and South Korea, and do not rely on the US market. Their overseas manufacturing bases also provide a buffer zone.

The United States is the second largest cleaning appliance market in the world after China. The American company iRobot has a dominant position in the sweeper market, but it has lost its presence in European countries in the competition with Chinese companies. Now the US market is the last important fortress for Chinese companies to break through.

Controllable damage

Dreimer Technology has decided to keep the price of its sweepers in the United States unchanged.

Dreimer Technology takes a high-end route in the global market. Through online channels such as Amazon, its products reach Europe, the United States, Japan and South Korea. Although there are important competitors such as iRobot in the United States, Dreame Technology’s products are more expensive than iRobot’s similar products.

After the US tariff increase, Dreame’s sweepers maintained the same price, which means that the company is now more concerned about market sales to avoid weakening its competitiveness in the US market after the price increase.

Smart appliance brand MOVA also focuses on the high-end US market. After the tariff increase, the price of its sweepers on the Amazon platform remained basically unchanged.

Dreame Technology’s floor scrubber products have adopted a different strategy. After the US imposed tariffs, the company’s floor scrubber prices were adjusted accordingly, and the tariff burden will be shared by Dreame Technology and its US consumers.

“Although tariffs will bring certain pressure, we have developed foam washing, hair cutting 2.0, and external drying technologies to increase the premium ability of our products.” Zhou Jiayu, product manager of Dreame floor scrubbers, said, “We believe that by launching newer technologies overseas and increasing product premium ability, we can offset the impact of tariffs on us.”

The two networks woven by Chinese companies around the world have made them immune to the heavy blow of US tariffs: one is a decentralized sales network, and the other is a global manufacturing network.

Almost all Chinese cleaning appliance companies are born global organizations. The countries that Amazon, AliExpress and other e-commerce companies can reach are all terminal markets for Chinese companies. Germany, France and Spain in Europe, Japan, South Korea and Vietnam in Asia are all stages for Chinese companies to display their talents.

A product of MOVA became a hit in the overseas market as soon as it was launched. Hu Bin, the company’s global R&D director, told China Business News: “The reason why we are so fast overseas is that the first is the precise selection of products for the pain points of European and American families, and the second is to use the mature overseas retail terminals to quickly deploy in the early stage of the business. These two points are very helpful for our rapid overseas development.”

Zhou Chen, head of MOVA China, told reporters that MOVA’s main overseas market is still in Europe, although the United States is currently the largest economy.

Companies such as Dreame Technology, Roborock Technology and Ecovacs have a strong presence in Europe. It can be said that Chinese cleaning appliance companies are already the leaders in the European market, while companies in other countries have a weak presence. China is the world’s largest cleaning appliance market, and Chinese local companies such as Dreame Technology and Roborock Technology have taken more than 90% of the market share.

It can be said that Chinese companies are casting a net around the world and do not rely on the US market.

At the same time, Chinese companies have begun to deploy their manufacturing links globally.

“Dreami has been a global company since its inception, and our supply chain is also globally deployed. In the face of US taxation, we will actively study and adjust corresponding strategies, formulate measures, optimize our production capacity layout, and reduce the impact of tariff policies on our business.” Meng Jia, president of Dreame Sweeping Robot, told the reporter of China Business News. “In the early stage, we may rely on overseas OEM production, but as the business volume increases, there will be more possibilities of self-built factories overseas. In the future, we will build a global supply chain layout so that products from different countries and regions are produced locally.”

In the first half of 2024, Ecovacs’ global revenue was 6.9 billion yuan, of which overseas sales were 2.8 billion yuan, accounting for about 40%.

Qian Cheng, vice chairman of Ecovacs, told China Business News that US tariffs will not have a key impact on Ecovacs. Starting this year, Ecovacs will coordinate overseas supply chains as appropriate. “It’s not a bad thing to put part of the supply chain in Vietnam and other Southeast Asian countries, because many of the consumer goods we produce are willing to be bought by the Vietnamese people.”

Among China’s top cleaning appliance companies, Stone Technology has the highest proportion of US revenue, so it is more affected by tariffs.

According to the record of Stone Technology’s investor communication activities in January, the company said, “Since the adjustment of tariff policies at the end of June (2024), the company has actively studied and formulated strategies and taken measures to reduce the impact of tariff policies on the company’s business. The fourth quarter of 2024 is an important time for global sales. Combined with the company’s stocking rhythm, the tariff policy will continue to have an impact on us in the fourth quarter.”

Starting from October 2024, Stone Technology’s foundry in Vietnam has begun to ship products one after another. At the end of the year, many products were shipped from the foundry in Vietnam to supply the US market to alleviate the impact of tariffs.

Attack and defense of the US market

“The United States is where we will focus our efforts in the next stage, because the United States is the second largest single market in the world, and the largest single market is China.” Meng Jia said. Dreame Technology’s sweeping robots occupy a major market position in Germany and France, and it regards the US market as the next fortress to be broken.

At present, iRobot is still the largest brand in the North American sweeper market.

Amazon is the core online channel in North America, while the core offline channels are large supermarkets such as Walmart and Costco. Chinese companies have previously used online channels such as Amazon to directly enter the US market and have achieved certain results. However, the construction of offline channels is more tortuous and complicated than online channels. Brands such as iRobot have an advantage offline.

“We will continue to focus on both online and offline channels.” Meng Jia said.

Roborock’s sales in the North American market mainly come from Amazon channels, while sales in offline channels account for a relatively low proportion.

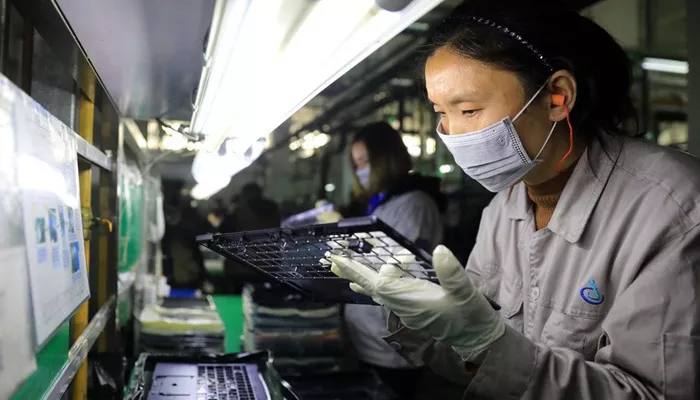

Chinese cleaning appliance companies generally have their own factories, which means that the pace from design to trial production and then to large-scale production can be faster. MOVA, Dreame Technology, and Ecovacs have factories in Suzhou, while Roborock’s factory is in Huizhou City.

“We are now producing our own cleaning products, sweepers, scrubbers, and vacuum cleaners.” Zhou Chen said that MOVA’s core components such as motors are also self-produced. Currently, MOVA has more than 1,000 employees, and nearly 70% of them are R&D personnel. “In this era, we hope that R&D investment will be high from the beginning. Only when the density of R&D personnel is sufficient can product innovation be guaranteed.”

iRobot cooperates with third-party foundries. Previously, the foundry business was concentrated in China, but now the manufacturing process has been transferred from China to Malaysia. In terms of product innovation and iteration capabilities and speed, Chinese companies have left iRobot behind.

“For so many years, its products have hardly been upgraded. At most, it was a pure sweeping machine before, but now it has an additional flat mop.” Meng Jia believes that Chinese companies have also caught up with or even surpassed iRobot in software algorithms. iRobot is most famous for its visual algorithm. It is the first manufacturer to do VSLAM (Visual Simultaneous Localization and Mapping) technology, and its technology is profound. But now domestic companies have surpassed it in this field of technology.

According to people who have contacted iRobot employees, the company’s customer demand verification is slow, and it takes a year to determine a customer demand after layers of approval. One year is enough for Chinese companies to iterate their products twice.

“I think it’s not just sweepers that are the problem for European and American companies. You can also see that the overseas brands that used to be so high up have been rapidly replaced by Chinese brands in recent years. The most important reason is that they are too slow. Whether it’s the degree of response to user needs or their corporate work culture, I think they are far behind some Chinese companies.” Meng Jia believes, “The speed of companies is no longer at the same level. It is inevitable that we will quickly surpass them.”

Related topics: